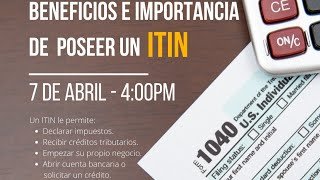

ITIN Number Benefits

The Individual Taxpayer Identification Number (ITIN) is a critical component of the U.S. tax structure. Issued by the Internal Revenue Service (IRS), the ITIN is assigned to individuals who do not qualify for a Social Security number (SSN) but need a tax identification number.

This includes certain resident and nonresident aliens, dependents and spouses of U.S. citizens or resident aliens.

Its main purpose is to facilitate compliance with tax obligations for individuals who are unable to obtain an SSN.

Importance of the ITIN in Tax Returns

The ITIN is essential for those who are required to file a U.S. federal income tax return and do not have an SSN.

This number allows taxpayers to file their returns and, in some cases, qualify for certain tax benefits. For example, it can be used to obtain the Child and Dependent Care Credit for foreign dependents from Canada or Mexico. Despite its importance in the tax system, the ITIN does not authorize employment in the U.S. nor does it grant Social Security benefits.

Services and Benefits Associated with ITIN

Access to IRS Online Services and Renewal Process

ITIN holders can access various IRS online services, such as reviewing balances due, payment histories and payment plans.

To use these services, it is necessary to complete a registration and identity verification process. It is important for ITIN holders to be vigilant about renewing their number, as it may expire if it is not used on a federal tax return for three consecutive years.

ITIN Applications and Limitations

Although the ITIN is a tax tool, its usefulness extends to other areas. It can be used to open bank accounts, apply for credit cards and, in some states, obtain driver’s licenses.

However, it is crucial to understand that the ITIN does not equate to an SSN in terms of rights and benefits. It does not provide legal status or the right to work in the U.S., and does not qualify holders for most government social benefits.

Final ITIN Considerations

The ITIN in the Immigration and Legal Context

The ITIN does not alter an individual’s immigration status nor does it provide a pathway to legal residency or citizenship.

However, its use on tax returns can play a role in immigration regularization processes, demonstrating compliance with U.S. tax laws.

The Relevance of the ITIN for Non-Citizens

Despite its limitations, the ITIN is a valuable tool for millions of people in the United States, especially those who are not eligible for an SSN.

It facilitates not only compliance with tax obligations, but also access to financial services and participation in certain legal and economic activities within the country.

Here is a summary table that summarizes the key information about the ITIN (Individual Taxpayer Identification Number).

| Appearance | Detailed Description |

|---|---|

| What is an ITIN? | A number issued by the IRS to individuals who need a U.S. tax ID but do not qualify for an SSN. Includes certain resident and nonresident aliens, dependents and spouses of U.S. citizens or resident aliens. |

| Primary Use of ITIN | Facilitates compliance with tax obligations for those who do not have an SSN. It allows taxpayers to file their tax returns and access certain tax benefits. |

| Access to IRS Services | ITIN holders can access IRS online services, including balance checks, payment histories and payment plans. Requires a registration and identity verification process. |

| ITIN Renewal | Required if the ITIN has not been used on tax returns for three consecutive years. Holders must be attentive to renewal in order to maintain their validity. |

| Benefits and Limitations | The ITIN allows you to open bank accounts, apply for credit, and in some states, obtain driver’s licenses. It does not provide legal status, the right to work in the U.S., or access to most government social benefits. |

| ITIN and the Immigration Context | It does not alter immigration status or provide a pathway to legal residency or citizenship. However, it can be useful in immigration regularization processes as proof of tax compliance. |

| Importance of the ITIN | Essential for millions who are not eligible for an SSN. It facilitates not only tax compliance, but also access to financial services and participation in certain U.S. economic and legal activities. |

This table provides a concise and organized summary of relevant information about the ITIN, highlighting its purpose, functionality, and impact on different aspects of life in the U.S. for individuals who use it.